GST Calculator Australia (2026)

Australian GST Calculator (10%)

This calculator uses the standard 10% GST rate in Australia.

Running a business? Need help with GST, BAS, or bookkeeping?

How To Calculate Australian Goods And Services Tax (GST)

To calculate the GST, enter the amount in the price field & select Add GST or Subtract GST. Our GST Calculator will show you the GST amount at Australia’s 10% GST rate.

The goods and services you sell in Australia are generally taxable unless they are GST-free.

This NSW GST Tax Calculator will help you calculate your exact GST price.

This GST tax calculator will help you find out

- How to calculate GST in Australia

- How much GST do you need to pay or charge your customers

- Identify the INCLUSIVE GST and EXCLUSIVE GST

You can use this GST Cal for your GST

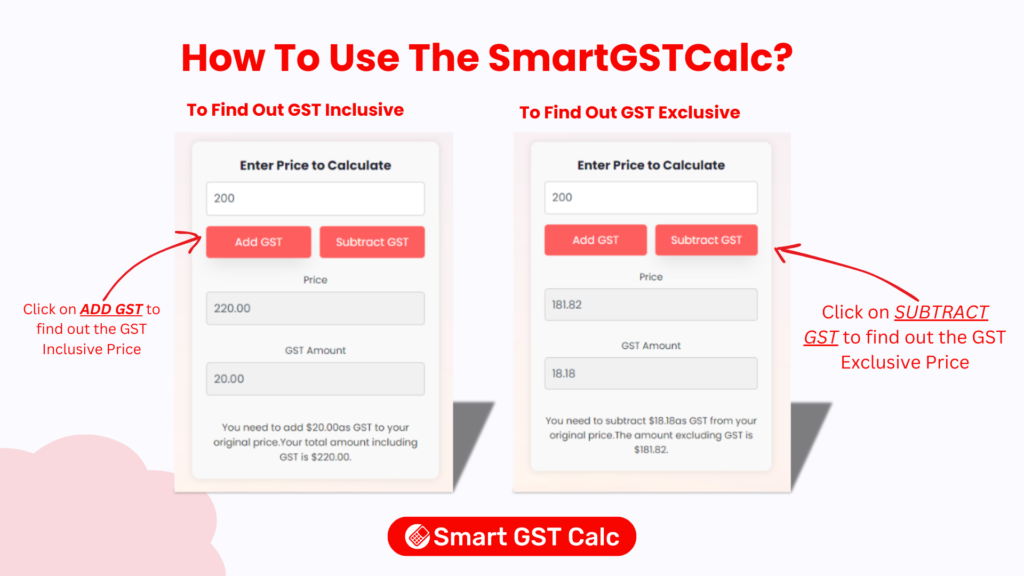

How To Use The Smart GST Calc?

The image below shows how to use our SmartGSTcalc. Let’s have a look!

Step 1:

In the price field, you need to add your price.

Step 2:

Then you need to click on either ADD GST OR SUBTRACT GST according to your requirements. Our SmartGSTCalc will show the calculations at the bottom of the GST calculator, and you will know exactly how much GST you need to add or subtract from your original price.

What is Australian GST?

GST refers to the goods and services tax (GST). It is a type of value-added tax (VAT), this is the most modern form of taxation that the Australian government has adopted, and this is one of the lowest GST rates in the World. Over 160 countries have adopted this kind of tax considering its popularity as an effective source of generating money.

One of its key features is its multi-stage nature, which means the GST is collected on every step of a product’s journey, from raw materials to final purchase.

This new tax system was introduced by the then-Howard Liberal government in Australia in July 2000.GST is a broad-based tax applied to the value of most goods and services that we buy or sell. Currently, the current GST rate is 10% in Australia.

How To Calculate GST Australia?

Calculating GST is super easy once you understand the basics. Here is a step-by-step process to calculate GST (Goods and Services)

Identifying The GST Applicable Amount.

First of all, you need to determine the total value of the goods or services for which GST is applicable. This contains the base price of the goods or services plus any additional charges such as delivery fees, packaging costs, or membership fees.

Applying The GST.

Once you have identified the applicable GST amount, multiply it by the current GST rate. The standard GST rate in Australia is 10%, but in some cases, this rate could be higher; luxury items may have a higher GST rate, while others may be GST-free.

Calculating The GST Amount.

Now, the GST amount is simply the amount that must be paid on the goods or services supplied. For example, if the total value of goods or services is $100, and the GST rate is 10%, then the GST amount would be $10.

Finally, Adding The GST To The Base Price.

So, now you have to find out the total price including the GST. Simply add the GST to the base price. Considering the above example, our total price including the GST would be $110 ( $100 + $10= $110)

An alternate way of calculating GST in Australia.

If you don’t want any guesswork or manual calculation, use our Smart GST Calc. This is a quick way to calculate GST Austria at a 10% GST rate. Enter your desired amount in our GST Calc, select ADD GST OR SUBTRACT GST, and hit CALCULATE GST to see the results.

How Much Is GST In Australia?

The Current GST (Goods and Services Tax) rate in Australia is 10%, which means for every $100 worth of goods or services you purchase, you will have to pay an additional $10 in GST.

The GST rate is applied to most goods and services sold in Australia, but there are still some exceptions. Let’s have a look at the table below.

The businesses in Australia that have a GST turnover of $75000 are required to register for the GST. It means they have to collect the GST from their customers and pay it to the Australian Taxation Office (ATO)

Who can claim back the GST?

There are two groups who can claim the GST back: first, the businesses that are registered for GST, and second, Tourists using the Tourist Refund Scheme (TRS).

Businesses registered for GST can claim back the GST on goods and services purchased for business use. Businesses can claim GST credits by lodging a Business Activity Statement (BAS) with the Australian Taxation Office (ATO).

GST Return and payment workout

Here is a step-by-step guide on how to calculate your GST return and payment in Australia. I will give real-time examples to help you understand the process.

1. Calculating GST on sales (GST Collected)

First, you have to find out the total GST, which is the GST you have collected on your sales from customers (output tax)

For Example:

- You sell a product or service that is worth $110, including the GST. This means the GST portion is $10 based on a 10% GST rate in Australia.

- Repeat this for all of your sales, including the GST.

Calculation Example:

Let’s assume that you sold products worth $5500 (including GST), then the GST collected would be as follows.

GST COLLECTED = 5500/11 = 500AUD

2. Calculating GST on purchase for your business (GST paid)

Now, we have to find out the total GST you have paid on goods you purchased for your business use(Input Tax).

For Example:

- Let’s say you buy office supplies worth $220, including the GST, then the GST is portion is $20 based on a 10% GST rate.

- Calculate all the GST you have paid on business purchases.

Calculation Example:

Assume that you bought office supplies worth $2200, including the GST, then the GST paid on supplies would be as follows.

GST PAID= 2200/11 = 200AUD

3. Now work GST payable or refundable

Subtract the GST on purchases from the GST on sales to consider whether you need to pay GST to the ATO or get a refund.

Formula:

GST Payable/Refundable = GST Collected−GST Paid

Example:

- GST Collected = $500

- GST Paid = $200

- So we get 500−200= 300AUD

This means you owe the ATO $300.

How to register for gST?

To register your business for GST collection, your business needs to meet the specific criteria. In Australia, not all businesses can register for GST; instead, any business that has a turnover of $75000 per year can register their business for GST. If your business meets this threshold, then visit our dedicated article on how to register for GST in Australia?

How To Calculate GST From the Total Amount?

To find out the GST from the total, you simply have to multiply the total amount by the applicable GST rate.

For example, if the total amount of the goods or services purchased is $1000, then the GST amount can be calculated as follows, given that the current GST rate in Australia is 10%.

- GST amount = Total amount * GST rate/100

- GST amount = $1000 * 10 / 100

- The GST Amount = $1000 * 10 / 100

- GST Amount = $100.

Therefore, the GST amount of $1000 is $100. which means for every $1000 spent, an additional $100 is paid as GST in Australia.

GST Calculation Formula

Here Is The Calculation For GST

To work out the 10% GST, you will have to multiply the price before GST by 1.1 (for example $100 multiplied by 1.1= $10 and the total cost now is $110)

Having said that, the reverse GST calculator method is a little bit complicated. Here is what you have to do.

How to calculate GST inclusive?

- To calculate how much GST was included in the price, simply divide the price by 11.

- Example: $550/11=$50

- To calculate the price without GST, simply divide the price by 1.1

- Example: $550/1.1= $500.

Here is another easy formula to calculate GST,

Total price including GST = Base price + (Base price × GST rate)

Where

- The total price, including GST, is the total price you will have to pay, including the GST.

- The base price is the original value of the goods or services before adding the GST.

- The GST rate is the current GST rate in Australia, which is 10% at the moment.

For example, if the base price of the product is $100, then the total price including GST would be as follows.

Total price including GST = $100 + ($100 × 0.10) = $110

In addition, I would strongly recommend using our Smart GST Cal, which calculates both INCLUSIVE GST AND EXCLUSIVE GST at a 10% GST rate, but you can also select other GST rates, like 10%, 12.5%, and 15%.

Avoid This GST Calculation Mistake.

First, I would strongly recommend using this GST cal Australia, but still, if you want to do a manual GST calculation, then avoid this kind of mistake.

For Example:

10% of $200 is $20, your GST INCLUSIVE price is $220. This is correct. ($200+10% = $220)

But if the price before GST is $220, then GST EXCLUSIVE would be $198. ($220-10% = $198), As some people miscalculate the percentage

List Of GST On Different Prices In Australia

| # | Price including GST | GST amount (10%) | Price excluding GST |

|---|---|---|---|

| 1 | $100 | $9.09 | $90.91 |

| 2 | $200 | $18.18 | $181.82 |

| 3 | $300 | $27.27 | $272.73 |

| 4 | $400 | $36.36 | $363.64 |

| 5 | $500 | $45.45 | $454.55 |

| 6 | $600 | $54.55 | $545.45 |

| 7 | $700 | $63.64 | $636.36 |

| 8 | $800 | $72.73 | $727.27 |

| 9 | $900 | $81.82 | $818.18 |

| 10 | $1000 | $90.91 | $909.09 |

| 11 | $1500 | $136.36 | $1363.64 |

| 12 | $2000 | $181.82 | $1818.18 |

| 13 | $3000 | $272.73 | $2727.27 |

| 14 | $4000 | $363.64 | $3636.36 |